As we approach tax season, it’s essential for Asian individuals to understand the significance of the W-2 form in managing their taxes. The W-2 form is a crucial document provided by employers to their employees, summarizing their annual earnings and the amount of taxes withheld from their paychecks.

What is a W-2 Form?

The W-2 form serves as a comprehensive record of an individual’s income earned during the tax year, as well as the taxes withheld from their wages. It includes details such as the employee’s name, social security number, employer information, and income earned from wages, tips, and bonuses.

The W-2 form serves as a comprehensive record of an individual’s income earned during the tax year, as well as the taxes withheld from their wages. It includes details such as the employee’s name, social security number, employer information, and income earned from wages, tips, and bonuses.

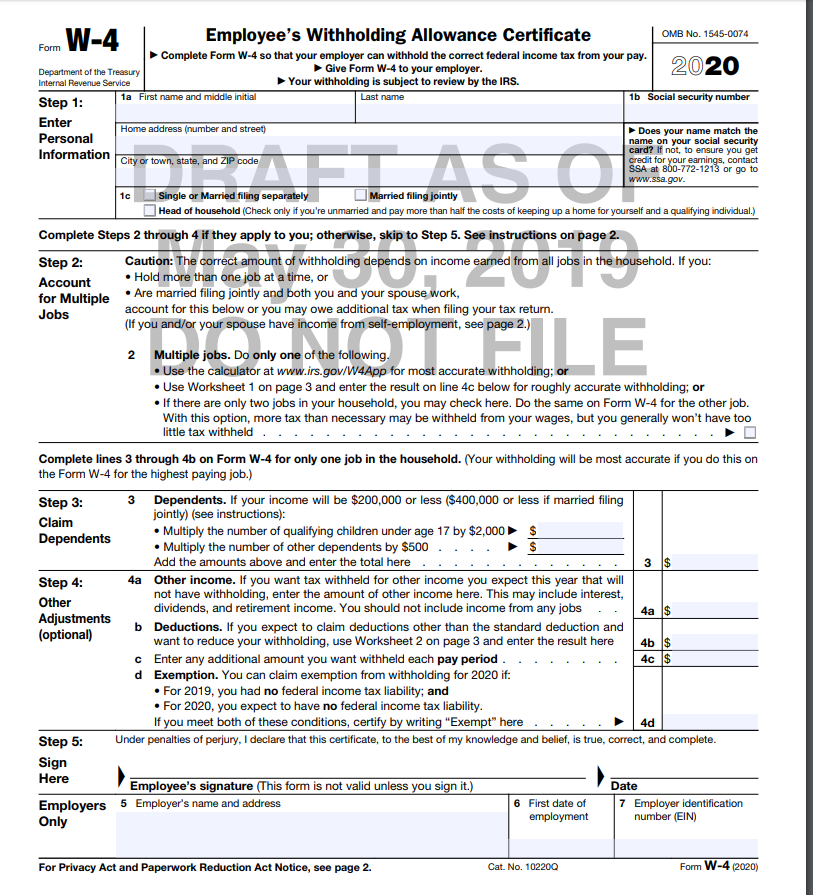

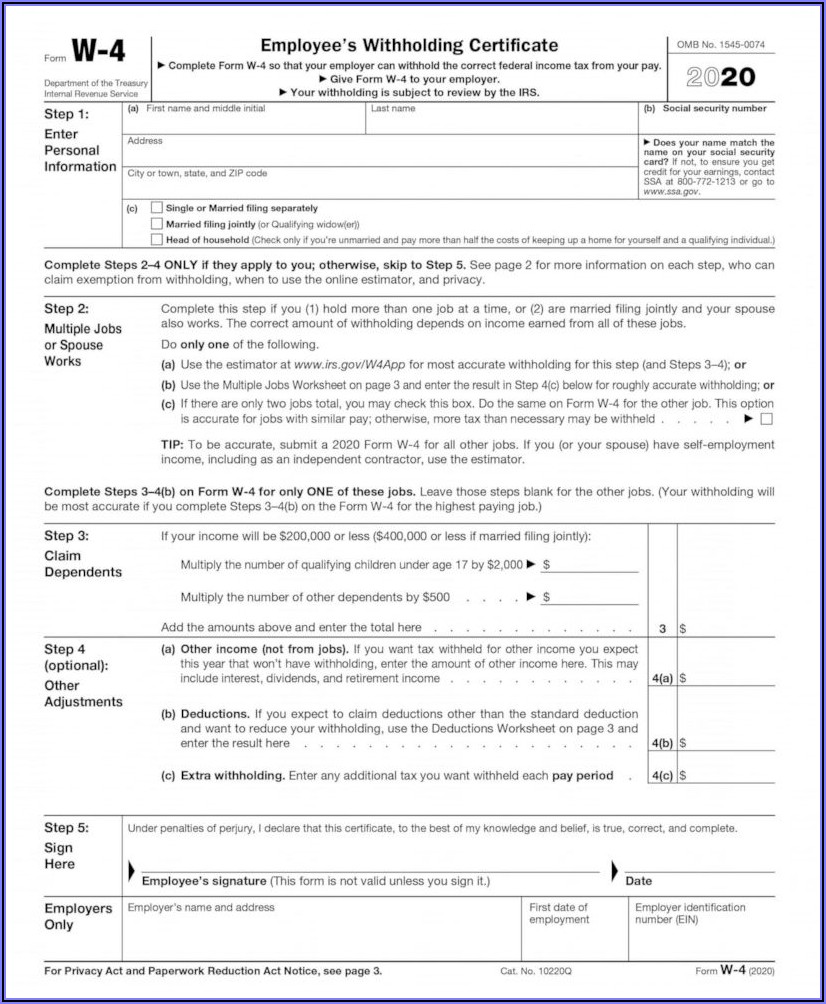

New W2 Form For 2020 - 2022 W4 Form

The W-2 form has undergone some changes in recent years, such as the introduction of the new W-4 form in 2020. It is essential for Asian individuals to stay updated with these changes to ensure accurate reporting of their income and withholding information.

The W-2 form has undergone some changes in recent years, such as the introduction of the new W-4 form in 2020. It is essential for Asian individuals to stay updated with these changes to ensure accurate reporting of their income and withholding information.

2022 W-2 Fillable - Fillable Form 2023

One significant advancement in recent years is the availability of fillable W-2 forms online. Asian individuals can find these forms in a fillable format, making it easier to enter their information electronically and generate a clean, legible W-2 form.

One significant advancement in recent years is the availability of fillable W-2 forms online. Asian individuals can find these forms in a fillable format, making it easier to enter their information electronically and generate a clean, legible W-2 form.

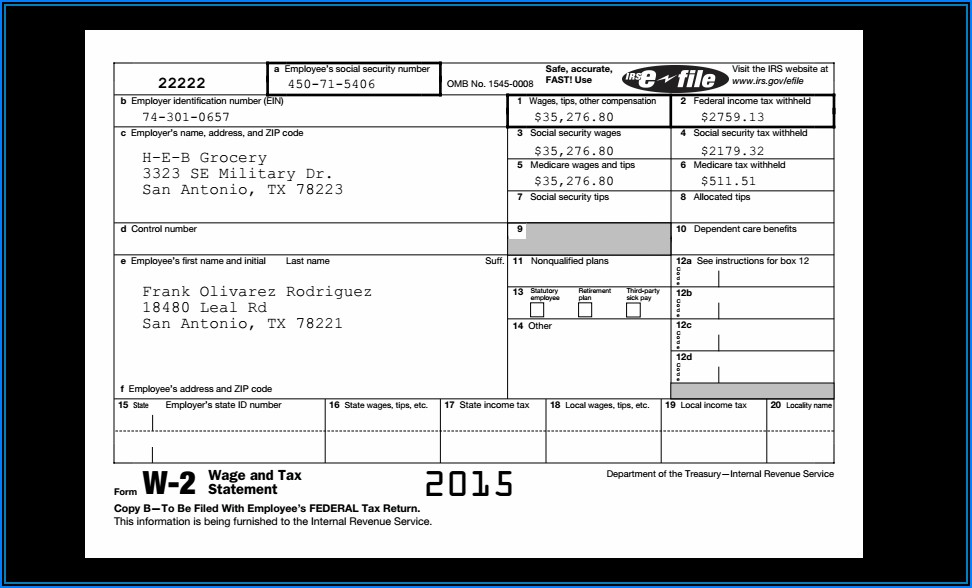

W2 Form 2022 - W-2 Forms - TaxUni

Online platforms like TaxUni provide Asian individuals with detailed information about W-2 forms, ensuring they have the necessary knowledge to complete and file their taxes accurately. It is crucial to understand the various sections and items on the form to avoid any errors or omissions.

Online platforms like TaxUni provide Asian individuals with detailed information about W-2 forms, ensuring they have the necessary knowledge to complete and file their taxes accurately. It is crucial to understand the various sections and items on the form to avoid any errors or omissions.

IRS W-2AS 2020-2022 - Fill out Tax Template Online | US Legal Forms

For Asian individuals who require additional assistance with filling out their W-2 forms, online platforms like US Legal Forms offer fillable tax templates. These templates guide individuals through each section of the W-2 form, ensuring accurate and complete reporting of income and withholding details.

For Asian individuals who require additional assistance with filling out their W-2 forms, online platforms like US Legal Forms offer fillable tax templates. These templates guide individuals through each section of the W-2 form, ensuring accurate and complete reporting of income and withholding details.

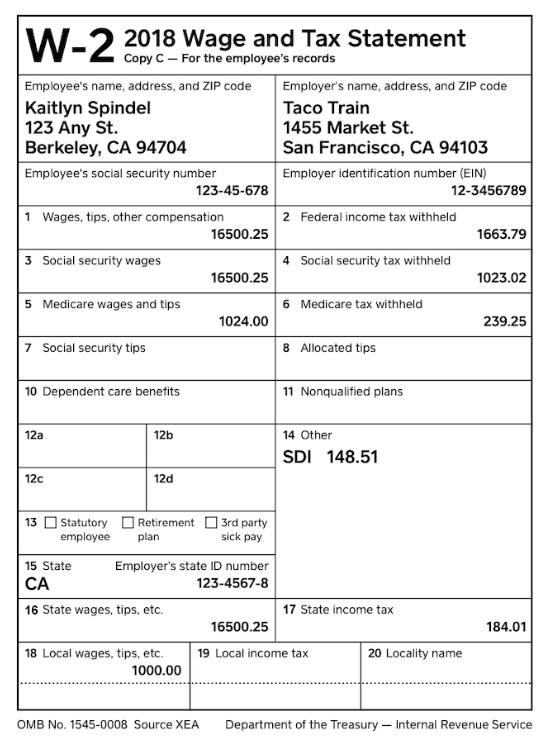

W2 Form Copy A 2018 - Form : Resume Examples #MeVRB6LjVD

It’s vital for Asian individuals to retain a copy of their W-2 forms for record-keeping purposes. Employers typically provide employees with a copy of their W-2 form for each tax year. These copies are essential when filing tax returns and may be required for future reference.

It’s vital for Asian individuals to retain a copy of their W-2 forms for record-keeping purposes. Employers typically provide employees with a copy of their W-2 form for each tax year. These copies are essential when filing tax returns and may be required for future reference.

W2 Forms 2020 Printable - 2022 W4 Form

Printable W-2 forms are readily available for Asian individuals who prefer to manually fill out their forms. Platforms like 2022 W4 Form provide printable versions of the W-2 form, allowing individuals to complete them by hand accurately.

Printable W-2 forms are readily available for Asian individuals who prefer to manually fill out their forms. Platforms like 2022 W4 Form provide printable versions of the W-2 form, allowing individuals to complete them by hand accurately.

Online Fillable W 4 Form - Printable Forms Free Online

Similar to the fillable W-2 forms, online platforms like Printable Forms Free Online provide Asian individuals with the convenience of a fillable W-4 form. This allows for easy completion and submission of the form to their employers, ensuring accurate tax withholding.

Similar to the fillable W-2 forms, online platforms like Printable Forms Free Online provide Asian individuals with the convenience of a fillable W-4 form. This allows for easy completion and submission of the form to their employers, ensuring accurate tax withholding.

Printable W2 Form For New Employee

Employers play a crucial role in providing their Asian employees with the necessary W-2 forms. It is their responsibility to ensure accurate and timely distribution of these forms to their employees, including new hires. Printable versions of the W-2 form are valuable in this process.

Employers play a crucial role in providing their Asian employees with the necessary W-2 forms. It is their responsibility to ensure accurate and timely distribution of these forms to their employees, including new hires. Printable versions of the W-2 form are valuable in this process.

Massachusetts W 2 Form Printable - Printable Forms Free Online

It is important to note that some states, like Massachusetts, may have additional requirements or variations to the W-2 form. Printable versions catered specifically to Massachusetts residents are available online, ensuring compliance with state-specific regulations for Asian individuals residing there.

It is important to note that some states, like Massachusetts, may have additional requirements or variations to the W-2 form. Printable versions catered specifically to Massachusetts residents are available online, ensuring compliance with state-specific regulations for Asian individuals residing there.

As Asian individuals navigate the tax season, understanding the W-2 form’s purpose and its various formats is crucial. Whether opting for fillable online forms or printable versions, the accuracy and completeness of the information provided are paramount. By staying informed and utilizing available resources, Asian individuals can ensure a smooth and accurate tax-filing experience.