Planning and managing your finances can sometimes feel like an overwhelming task, especially when it comes to loans and mortgages. But fear not! In this post, we will introduce you to the concept of an amortization schedule and how it can help you stay on top of your loan repayments.

What is an Amortization Schedule?

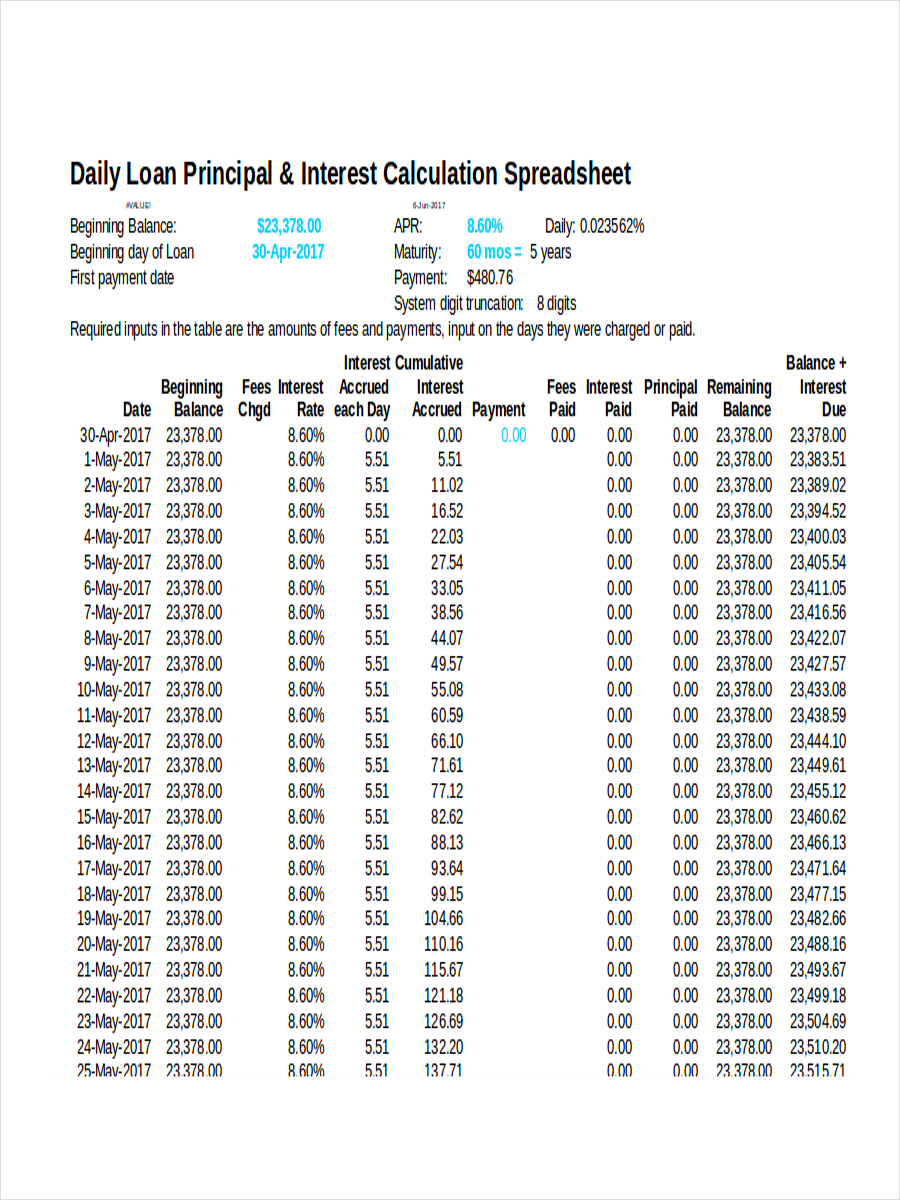

An amortization schedule is a table that details the repayment plan for a loan over a specific period. It breaks down each payment into its principal and interest components, helping borrowers understand how their loan balance decreases over time.

Visualizing your repayment plan in an amortization schedule can be a game-changer. It provides a clear overview of your loan’s progress, allowing you to track how much you owe and when you will be debt-free. With this information, you can make informed decisions and adjust your budget accordingly.

Visualizing your repayment plan in an amortization schedule can be a game-changer. It provides a clear overview of your loan’s progress, allowing you to track how much you owe and when you will be debt-free. With this information, you can make informed decisions and adjust your budget accordingly.

Importance of an Amortization Schedule

An amortization schedule offers several benefits, making it an essential tool for borrowers:

- Understanding Payment Breakdown: The schedule shows the division of each payment between principal and interest. Knowing this breakdown helps you see how much of your payment is going towards reducing the principal balance and how much is being spent on interest payments. Over time, the proportion allocated towards principal repayment increases, which accelerates your progress towards becoming debt-free.

- Budgeting and Financial Planning: By mapping out your payments, an amortization schedule makes it easier to plan your finances. You can see when your loan balance will decrease significantly, allowing you to allocate funds for other financial goals or even plan for early loan repayment.

- Interest Savings: By understanding how interest is calculated, you can strategize to save money on interest payments. For example, you may choose to make additional principal payments or refinance your loan to take advantage of lower interest rates. An amortization schedule helps you assess the impact of such decisions.

Creating an amortization schedule is easy, and there are several tools available to assist you. You can find pre-designed templates that allow you to input your loan details and generate a customized schedule in minutes. These templates are available in various formats, including Excel, Word, and PDF, making them compatible with different software platforms.

Creating an amortization schedule is easy, and there are several tools available to assist you. You can find pre-designed templates that allow you to input your loan details and generate a customized schedule in minutes. These templates are available in various formats, including Excel, Word, and PDF, making them compatible with different software platforms.

For those who prefer an online solution, there are also websites and software tools that can automatically generate an amortization schedule for you. Simply provide the necessary loan details, and the system will generate a detailed schedule that you can print or download for future reference. This option is especially useful if you have multiple loans or want to compare different repayment scenarios.

Printable Amortization Schedule

If you prefer a physical copy of your repayment plan, you can easily print the amortization schedule. Printable schedules are available in PDF format, ensuring high-quality prints that you can refer to at any time.

Having a printout of your amortization schedule allows you to visualize your loan repayment journey offline. You can mark each payment as you make it, providing a sense of accomplishment and progress. Additionally, a printable schedule serves as a handy reference, especially when you need information about interest paid or remaining balance.

Having a printout of your amortization schedule allows you to visualize your loan repayment journey offline. You can mark each payment as you make it, providing a sense of accomplishment and progress. Additionally, a printable schedule serves as a handy reference, especially when you need information about interest paid or remaining balance.

Now that you understand the importance of an amortization schedule and how it can benefit you, it’s time to create your own schedule. Whether you choose a digital template or an online tool, make sure to input accurate loan details for the most precise results. With your amortization schedule in hand, you’ll be equipped to manage your loan effectively and achieve your financial goals.

Remember, staying informed and organized is the key to financial success. Start using an amortization schedule today and take control of your loan repayment plan!